Half year results for the six months ended 30th September 2022

Half year results for the six months ended 30th September 2022

23 November 2022

Catalysing the net zero transition to drive value creation

Strong foundations and increasing confidence in growth opportunities

- Results in line with expectations

- Transformation progressing across the group

- Good progress on execution of strategy and on track with all milestones

- Significant increase in demand for sustainable technology to address energy crisis and climate change

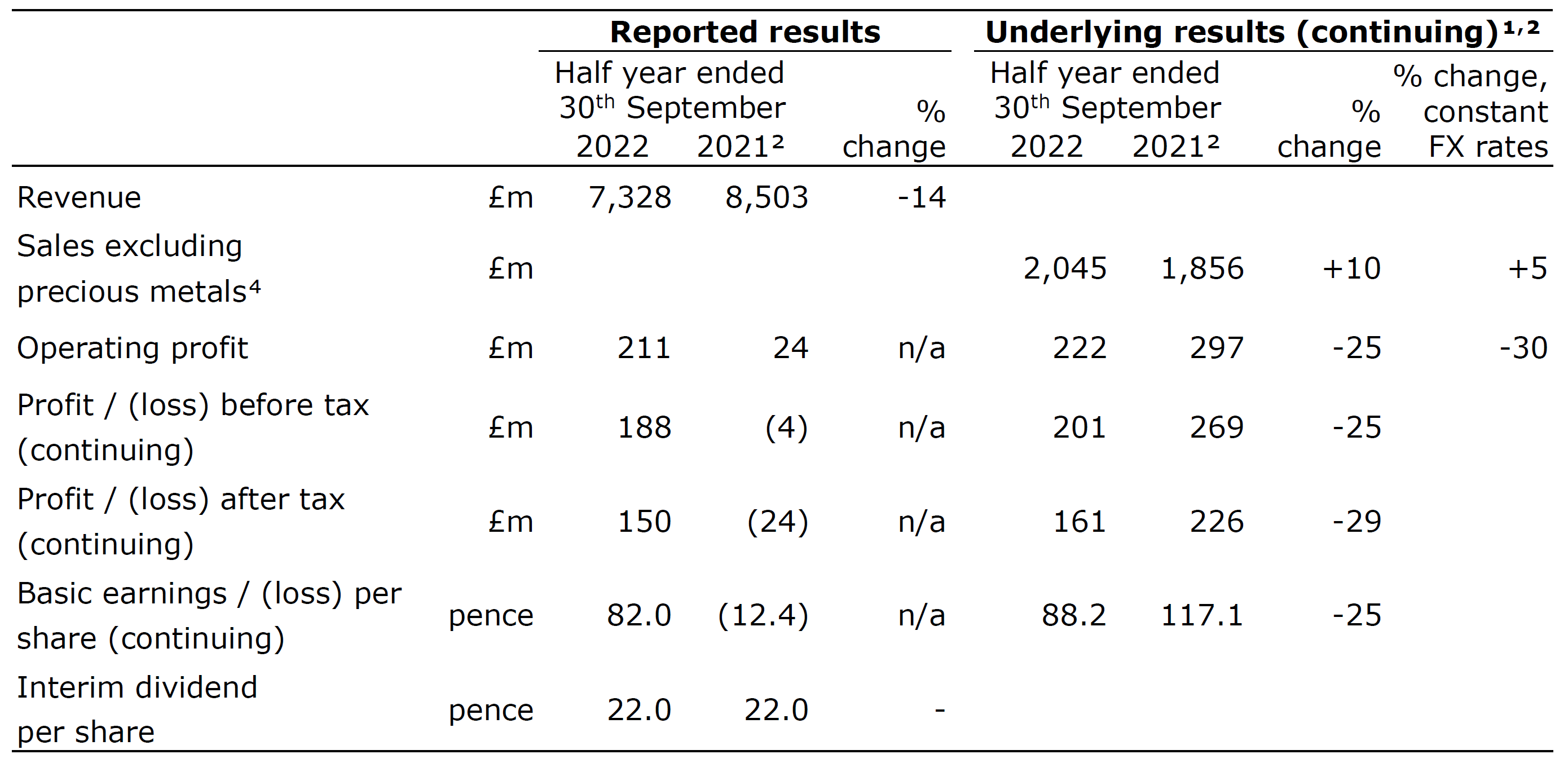

Underlying performance – continuing operations¹,²,³

- Sales of £2.0 billion, up 5%, with higher prices to partially recover cost inflation, partly offset by lower average PGM prices

- Underlying operating profit of £222 million, down 30%, reflecting supply chain constraints in Clean Air, lower average PGM prices and a lag in recovering cost inflation

- Underlying earnings per share of 88.2p, down 25% due to lower underlying operating profit

- Free cash flow of £133 million, compared to £190 million in the prior year largely reflecting lower underlying operating profit and working capital movements

- Strong balance sheet with net debt of £963 million; net debt to EBITDA of 1.5 times

Reported results²

- Revenue down 14%, driven by lower average PGM prices

- Operating profit of £211 million, up materially, largely due to the absence of a one-off impairment in the prior period relating to Battery Materials

- Profit before tax of £188 million, compared to a loss of £4 million in the prior period, reflecting higher operating profit due to the absence of the Battery Materials impairment

- Reported earnings per share (continuing) of 82.0 pence

- Cash inflow from operating activities of £145 million (1H 2021/22: £412 million)

- Interim dividend of 22.0 pence per share stable year-on-year

Liam Condon, Chief Executive, commented:

We are focused on effectively navigating the near-term macroeconomic challenges affecting our business, including significant cost inflation which we partially recovered in the half. We are confident of delivering a stronger performance in the second half as we apply the enhanced commercial focus and efficiencies that I outlined back in May.

Over the past six months, there have been further positive developments in the transition to net zero. Legislation such as the Inflation Reduction Act in the US, as well as the urgent need for sources of clean energy in Europe, are driving demand for sustainable technology solutions. We are in a strong position to benefit and enable our customers to decarbonise and meet their net zero goals.

As we move to a faster paced, more customer focused culture, we are already making good progress in achieving our strategic milestones. You can expect to see further progress in the coming months and I am more convinced than ever of the tremendous opportunities ahead for Johnson Matthey.

Outlook for the year ending 31st March 2023

The external environment is challenging, with continued political and economic uncertainty. We currently expect operating performance for the full year to be within the consensus range⁵. The outlook is based upon current foreign exchange rates prevailing for the rest of 2022/23⁶.

In Clean Air, supply chain disruption has eased through the first half and, whilst there is still uncertainty, we expect that automotive production volumes will improve further through the second half. For the year 2022/23, external data⁷ currently suggests auto production will be 4% higher than 2021/22, with volumes in the second half expected to be 4% higher than the first half. There is a lag in negotiating inflation claims with OEMs, which affected our first half profits. We are focused on further recovery of cost inflation, which we expect to benefit the second half, supported by benefits from our transformation programme. With continued volume recovery, we expect Clean Air operating performance in the second half to be above the first half.

PGM Services performance is driven by precious metals prices, both the absolute level and volatility, along with recycling volumes. Whilst precious metals prices are high relative to historic levels, they remain lower than the prior year. If they were to remain at their current level⁸ for the rest of this year, we would expect the adverse impact on full year operating performance to be c.£40 million⁹ compared with the prior year. At current metal prices, and with increased efficiencies and further measures to recover cost inflation, we expect PGM Services operating performance in the second half to be stronger than the first.

In Catalyst Technologies, whilst cost inflation was not fully recovered in the first half, we are focused on further increasing prices. As reported previously, the profit impact of lost business with Russia is mainly in Catalyst Technologies and in 2022/23 we expect this to be c.£10 million. This is expected to be one-off and compensated by new business from next year but will result in full year operating performance for Catalyst Technologies being lower than the prior year.

In Hydrogen Technologies we are investing to scale the business, to capture the significant opportunities that the rapidly growing hydrogen market presents. Consequently, we continue to expect a larger operating loss in 2022/23 than the prior year.

Longer term, we are already seeing signs that geopolitical developments are driving a significant acceleration towards a net zero carbon economy, and we are investing to capture the growth opportunities from our sustainable technology portfolio.

Dividend

The board approved an interim dividend of 22.0 pence per share, maintained at the same level as the prior year (1H 2021/22: 22.0 pence per share). The interim dividend will be paid on 1st February 2023, with an ex-dividend date of 8th December 2022, to shareholders on the register on 9th December 2022.

Enquiries

Investor Relations:

Martin Dunwoodie, Director of Investor Relations: +44 20 7269 8241

Louise Curran, Senior Investor Relations Manager: +44 20 7269 8235

Carla Fabiano, Senior Investor Relations Manager: +44 20 7269 8004

Media:

Barney Wyld, Group Corporate Affairs Director: +44 20 7269 8001

Harry Cameron, Tulchan Communications: +44 7799 152148

Notes:

1. Underlying is before profit or loss on disposal of businesses, gain or loss on significant legal proceedings together with associated legal costs, amortisation of acquired intangibles, share of profits or losses from non-strategic equity investments, major impairment and restructuring charges and, where relevant, related tax effects. For definitions and reconciliations of other non-GAAP measures, see pages 47 to 52.

2. 1H 2021/22 is restated to reflect the group’s new reporting structure as well as the classification of Health as a discontinued operation.

3. Unless otherwise stated, sales and operating profit commentary refers to performance at constant exchange rates. Growth at constant rates excludes the translation impact of foreign exchange movements, with 1H 2021/22 results converted at 1H 2022/23 average rates. In 1H 2022/23, the translational impact of exchange rates on group sales and underlying operating profit was a benefit of £97 million and £18 million respectively.

4. Revenue excluding sales of precious metals to customers and the precious metal content of products sold to customers.

5. Vara consensus for full year group underlying operating profit in 2022/23 was £487 million (range: £458 million to £516 million) as at 21st November 2022. 2021/22 group underlying operating profit on an adjusted basis was £553 million (adjusted for disposal of Health).

6. At current foreign exchange rates (£:US$ 1.16, £:€ 1.15, £:RMB 8.35) translational foreign exchange movements for the year ending 31st March 2023 are expected to benefit underlying operating profit by around c.£40 million, which is included in the outlook on page 3.

7. As forecast by external consultants – IHS (November 2022).

8. Based on average precious metal prices in November 2022 (month to date).

9. c.£40 million adverse impact represents a gross PGM price impact before any foreign exchange movement.

A US$100 change in the average annual platinum, palladium and rhodium metal prices each have an impact of approximately £1 million, £1.5 million and £1 million respectively on full year underlying operating profit. This assumes no foreign exchange movement.

Read more