Preliminary results for the year ended 31st March 2022

Preliminary results for the year ended 31st March 2022

Catalysing the net zero transition to drive value creation

26 May 2022

Reinvigorated strategy and new Leadership Team driving high performance culture

- Completed in-depth review of the business and strategy, assessing full range of options

- Simplified business portfolio focused on four businesses enabling the automotive, chemical and energy industries transition to net zero

- New transformation programme to deliver £150 million annualised cost savings by 2024/25, enhance decision-making pace and exploit synergy potential between sectors

- New global leadership team to drive high-performance culture and pace of strategic execution

- Focus on sustainable value creation accelerating to high single digit growth¹ over the medium term, and strong long-term growth, supported by a reliable dividend

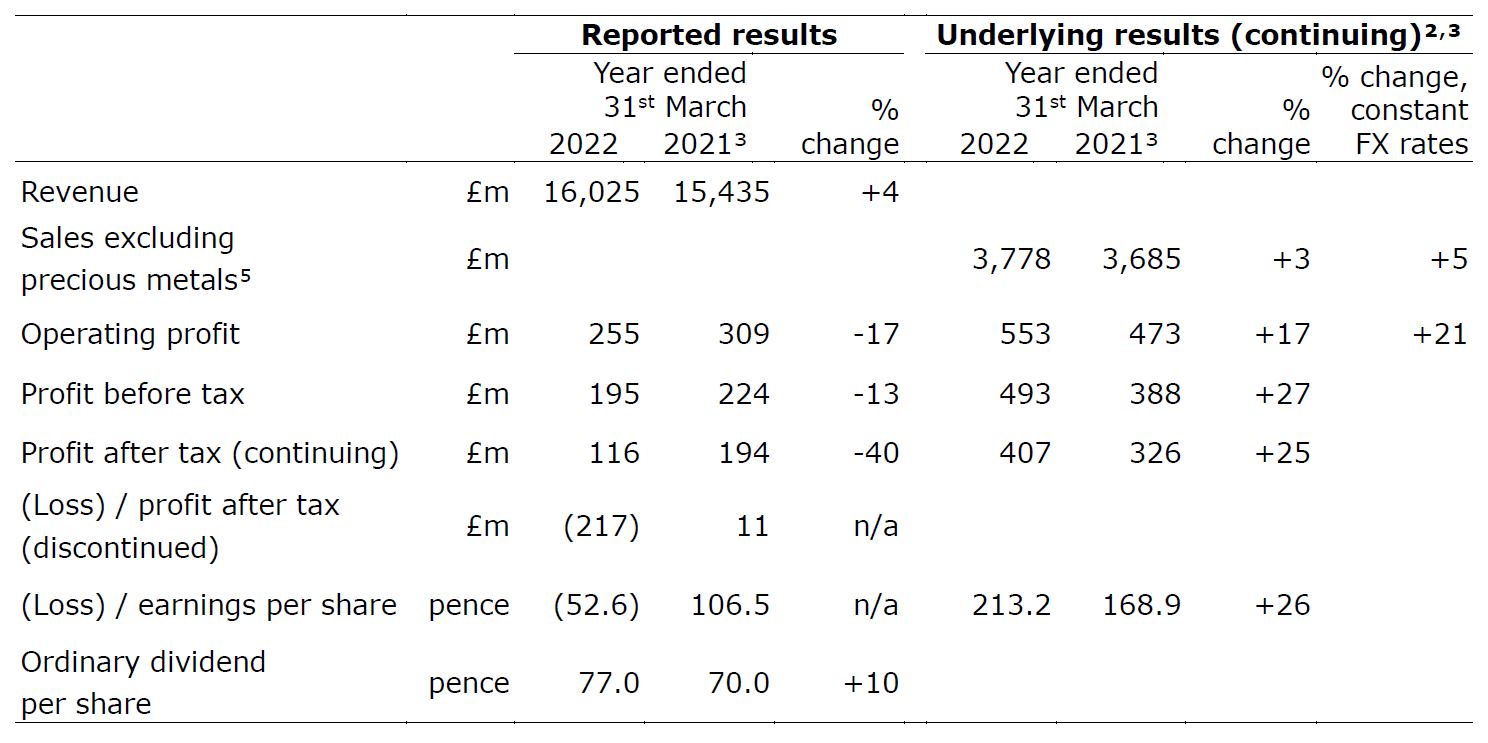

Underlying performance – continuing operations²,³,⁴

- Robust underlying results for 2021/22, in line with market expectations⁶

- Sales of £3.8 billion, up 5%, driven by a partial recovery in Clean Air and good performance in Efficient Natural Resources

- Underlying operating profit of £553 million, up 21%, driven by good performance in Clean Air and Efficient Natural Resources, higher average PGM prices and efficiencies

- Underlying earnings per share up 26% due to stronger operational results and lower net finance charges

- Free cash flow of £221 million, moderately down on the prior year

- Strong balance sheet with net debt of £856 million reflecting continued strong management of working capital; net debt to EBITDA of 1.2 times

Reported results³

- Revenue up 4% primarily driven by higher average precious metal prices

- Operating profit declined 17% to £255 million, largely reflecting the one-off impairment and exit costs for Battery Materials

- Profit before tax declined 13% to £195 million, reflecting lower operating profit which was largely impacted by the one-off impairment in Battery Materials

- Loss after tax on discontinued operations of £217 million including Health underlying operating profit of £3 million and an impairment and restructuring charge of £242 million relating to its sale that is expected to complete at the end of May

- Reported loss per share of 52.6 pence

- Cash inflow from operating activities of £605 million (2020/21: £769 million)

- Ordinary dividend of 77.0 pence per share, up 10%

- Share buyback of £200 million now complete

Patrick Thomas, Chair, commented:

This has been a very challenging year for Johnson Matthey and our shareholders. We took important and necessary strategic decisions with the business portfolio, with the exit from Battery Materials and divestment of Health. I know many of our stakeholders were very disappointed, but these were essential actions to enable us to focus on attractive, high growth opportunities that have a vital role to play in the acceleration towards net zero. I, the rest of the board and the executive team are determined that we will restore value to our shareholders.

Looking ahead, Johnson Matthey has a strong foundation from which to build and we have delivered a robust set of underlying results in the year. I am delighted to welcome our new Chief Executive, Liam Condon. Liam is a high calibre, proven business leader with considerable experience who brings a strong commercial focus as we leverage our world-class science and scale our growth opportunities. The board and I are pleased that Liam has settled in quickly and is already executing at pace and driving a more performance-oriented culture. We fully endorse the strategy Liam has proposed and look forward to supporting him in executing this to restore and drive value creation for shareholders.

Liam Condon, Chief Executive, commented:

I am delighted to have joined Johnson Matthey and am very excited about the potential of the group. Since joining in March I have completed an in-depth review of the business and strategy, assessing the full range of strategic options. I am very confident and determined that our reinvigorated strategy and planned cultural transformation will deliver value for all our stakeholders.

As the world decarbonises, Johnson Matthey has a pivotal role to play as a global leader in sustainable technologies. The net zero transition is both disrupting existing markets and, at the same time, creating new and bigger markets which depend on Johnson Matthey’s technology. By helping our automotive, chemical and energy industry customers to decarbonise, we will unlock tremendous growth potential for Johnson Matthey.

I am deeply impressed by the depth of talent and expertise within Johnson Matthey, but significant change is required to create a simpler, more focused group capable of better execution. We have already started executing at pace and I have taken steps to strengthen my executive team. We will continue to simplify our portfolio, focusing on our core activities and exploiting our leading-edge technologies, supported by our PGMs backbone. I am very confident we will create significant value with a faster paced, more customer-focused culture to become a high-performance leader in our important existing and exciting growth markets.

Outlook for the year ending 31st March 2023

For 2022/23, we are facing a period of greater political and economic uncertainty with a combination of factors that may affect the year ahead. Our performance for the full year will continue to correlate closely to levels of auto production and precious metal prices.

In Clean Air, although end customer demand remains robust, there continues to be supply chain disruption affecting many of our automotive customers constraining their production volumes, most recently with COVID-19 lockdowns in China and sourcing components from Ukraine. We expect conditions to ease through the year and Clean Air performance to improve with levels of auto production, although visibility remains low. For the year 2022/23 external data currently suggests auto production will be 5% higher than 2021/22. In this scenario, we would anticipate Clean Air operating performance to be broadly in line with 2021/22 with cost inflation being offset by further efficiencies. Clean Air has a flexible cost base, enabling us to manage different levels of activity, with around 75% of costs before mitigation being variable.

PGM Services continues to benefit from relatively high and volatile precious metals prices, albeit current prices are slightly below the prior year. If they were to remain at their current level⁷ for the rest of this year, we would expect the adverse impact on the full year to be around

£25 million⁸. We are also expecting slightly lower refinery intake volumes due to lower scrap levels with the semi-conductor chip shortage supporting a buoyant second-hand car market.

Catalyst Technologies end markets remain robust. As reported previously, we have limited operations in Russia representing around only 1% of group sales and a slightly higher proportion of group operating profit, mainly in Catalyst Technologies. The profit impact in Catalyst Technologies in 2022/23 of c.£10 million will be compensated by new business elsewhere thereafter.

In Hydrogen Technologies we are investing to enable us to scale at pace, to capture value from the significant opportunities rapidly growing hydrogen markets present. Consequently, we expect a larger operating loss in 2022/23.

At current foreign exchange rates⁹, translational foreign exchange movements for the year ending 31st March 2023 are expected to benefit underlying operating profit by around £25 million.

As a result, whilst visibility is low and the outcome for the year remains uncertain, we currently expect operating performance to be in the lower half of the consensus range.¹⁰

Longer term, we expect the current geopolitical situation to drive a significant acceleration towards a net zero carbon economy, with corresponding investment to position us strongly for significant growth opportunities from our sustainable technology portfolio.

Dividend and share buyback

The board will propose a final ordinary dividend for the year of 55.0 pence at the Annual General Meeting on 21st July 2022. Together with the interim dividend of 22.0 pence per share, this gives a total ordinary dividend of 77.0 pence representing a 10% increase on the prior year. Subject to approval by shareholders, the final dividend will be paid on 2nd August 2022, with an ex-dividend date of 9th June 2022. Our previously announced £200 million share buyback completed on 13th May 2022.

Enquiries:

Investor Relations:

Martin Dunwoodie, Director of Investor Relations: +44 20 7269 8241

Louise Curran, Senior Investor Relations Manager: +44 20 7269 8235

Carla Fabiano, Senior Investor Relations Manager: +44 20 7269 8004

Media:

Barney Wyld, Group Corporate Affairs Director: +44 20 7269 8001

Harry Cameron, Tulchan Communications: +44 7799 152148

Notes:

1. At constant precious metal prices and FX rates (2021/22 average).

2. Underlying is before profit or loss on disposal of businesses, gain or loss on significant legal proceedings together with associated legal costs, amortisation of acquired intangibles, major impairment and restructuring charges and, where relevant, related tax effects. For definitions and reconciliations of other non-GAAP measures, see pages 51 to 54.

3. 2020/21 is restated to reflect the group’s updated reporting segments and removal of inter-segment copper zeolite sales in Efficient Natural Resources as well as the classification of Health as a discontinued operation.

4. Unless otherwise stated, sales and operating profit commentary refers to performance at constant exchange rates. Growth at constant rates excludes the translation impact of foreign exchange movements, with 2020/21 results converted at 2021/22 average rates. In 2021/22, the translational impact of exchange rates on group sales and underlying operating profit was an adverse impact of c.£101 million and c.£17 million respectively.

5. Revenue excluding sales of precious metals to customers and the precious metal content of products sold to customers.

6. Vara consensus for full year group underlying operating profit in 2021/22 was £545 million

(range: £532 million to £561 million) as at 25th May 2022. 2020/21 group underlying operating profit was £504 million.

7. Based on average precious metal prices in May 2022 (month to date).

8. A $100 change in the average annual platinum, palladium and rhodium metal prices each have an impact of approximately £1 million, £1.5 million and £1 million respectively on full year underlying operating profit.

9. Based on foreign exchange rates in May 2022 (month to date).

10. Vara consensus for full year group underlying operating profit in 2022/23 was £562 million (range: £491 million to £641 million) as at 25th May 2022. 2021/22 group underlying operating profit on an adjusted basis was £559 million (adjusted for disposals of Health, Battery Materials and Advanced Glass Technologies).