Half year results for the six months ended 30th September 2024

Catalysing the net zero transition to drive sustainable value creation

27 November 2024

Continued strategic execution and transformation progress

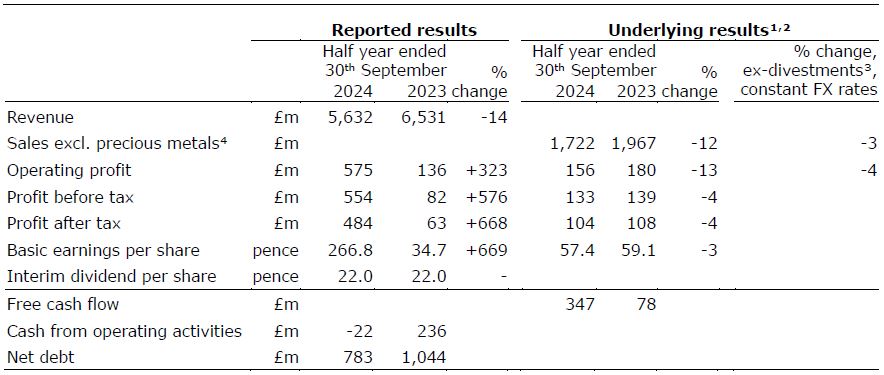

- A resilient performance with underlying operating profit excluding divestments down 4% – in line with our expectations – against a challenging macroeconomic backdrop

- Improved margins in Clean Air and Catalyst Technologies, and on track for targets

- Transformation programme continuing at pace – cumulative cost savings of £155 million delivered to date and on track to achieve £200 million by the end of 2024/25

- Making progress against our strategic milestones: three large scale project wins in Catalyst Technologies’ sustainable technologies portfolio and PGM refinery investment on track

- Strong balance sheet – net debt to EBITDA of 1.4 times: focused on driving improved cash

- £250 million share buyback programme – £205 million completed as at 22nd November 2024

- Full year outlook maintained, with performance more weighted to the second half driven by greater benefits from transformation and a stronger performance in PGM Services

Liam Condon, Chief Executive Officer, commented:

We delivered a resilient performance – in line with our expectations – and have continued to execute on our strategy in the first half, against a challenging macroeconomic backdrop. Our performance was supported by our transformation programme which is progressing well. For the full year, we are maintaining guidance with our confidence in the second half underpinned by further transformation benefits.

We are strongly focused on cash generation, with our established businesses driving cash to support the disciplined development of our growth businesses and further shareholder returns. Johnson Matthey has an important role to play in the global transition to net zero and our portfolio means we are well positioned to adapt to the evolving pace of this transition. We continue to secure important project wins in sustainable technologies, whilst building our capability and transforming at pace.

Group outlook for the year ending 31st March 2025 maintained

For 2024/25, excluding Value Businesses⁵, we continue to expect at least mid single digit growth in underlying operating performance at constant precious metal prices and constant currency. We expect our improved second half performance to reflect further transformation benefits as well as higher volumes and metal recoveries in PGM Services, where we have good visibility.

In Clean Air, in 2024/25, we expect modest growth in operating performance, with continued margin expansion driven by efficiency benefits. For the second half, we expect a sequential improvement in operating performance and margin.⁶

PGM Services’ operating performance in 2024/25 is expected to be broadly stable, with limited impact from precious metal prices. We expect to deliver a significantly stronger second half, driven by higher sales from increased refining volumes, higher metal recoveries and higher product sales, and further efficiencies as we optimise our cost base⁶

In Catalyst Technologies we expect further strong growth in operating performance in 2024/25, with a mid-teens margin. Following a strong first half performance in Licensing, we expect our second half operating performance to be slightly below the first half.⁶

In Hydrogen Technologies we now expect lower sales in 2024/25 (previously modest growth). For the full year, despite a lower contribution from sales, we will deliver a significantly lower operating loss as we take further action to reduce costs.⁶

If PGM (platinum group metal) prices remain at their current level⁷ for the remainder of 2024/25, we expect an adverse impact of £3 million to full year operating profit compared with the prior year.⁸

At current foreign exchange rates⁹, translational foreign exchange movements for the year ending 31st March 2025 are expected to adversely impact underlying operating profit by c.£10 million.

Dividend

The board has approved an interim dividend of 22.0 pence per share, maintained at the same level as the prior year (1H 2023/24: 22.0 pence per share). The interim dividend will be paid on 4th February 2025, with an ex-dividend date of 5th December 2024, to shareholders on the register on 6th December 2024.

Enquiries:

Investor Relations

Martin Dunwoodie: Director of Investor Relations and Treasury, +44 20 7269 8241

Louise Curran: Head of Investor Relations, +44 20 7269 8235

Chris Wood: Senior Investor Relations Manager, +44 20 7269 8138

Media:

Sinead Keller: Group External Relations Director, +44 20 7269 8218

Harry Cameron: Teneo, +44 7799 152148

Notes:

1. Unless otherwise stated, sales and operating profit commentary refers to performance at constant exchange rates. Growth at constant rates excludes the translation impact of foreign exchange movements, with 1H 2024/25 results converted at 1H 2023/24 average rates. In 1H 2024/25, the translational impact of exchange rates on group sales and underlying operating profit was an adverse impact of £29 million and £5 million respectively.

2. Underlying is before profit or loss on disposal of businesses, amortisation of acquired intangibles, share of profits or losses from non-strategic equity investments, major impairment and restructuring charges and, where relevant, related tax effects. For definitions and reconciliations of other non-GAAP measures, see pages 48 to 53.

3. Divestment of Value Businesses which is now complete.

4. Revenue excluding sales of precious metals to customers and the precious metal content of products sold to customers.

5. Baseline is underlying operating profit excluding Value Businesses (£381 million in 2023/24).

6. Outlook commentary for Clean Air, PGM Services, Catalyst Technologies and Hydrogen Technologies assumes constant precious metal prices and constant currency.

7. Based on average precious metal prices in November 2024 (month to date).

8. A US$100 per troy ounce change in the average annual platinum, palladium and rhodium metal prices each have an impact of approximately £0.5 million, £1 million and £0.5 million respectively on full year 2024/25 underlying operating profit in PGM Services. This assumes no foreign exchange movement.

9. Based on average foreign exchange rates for November 2024 month to date (£:US$ 1.28, £:€ 1.20, £:RMB 9.19).