Robust performance and growth opportunities driven by sustainable solutions

Robert MacLeod, Chief Executive, commented:

Our employees have done a tremendous job adapting to new ways of working through COVID-19, whilst still delivering for our customers. It is thanks to their hard work that we have delivered a robust set of results which, in the context of a pandemic, is especially pleasing and testament to their efforts.

Following a challenging first half, we recovered strongly in the second half helped by a strong recovery in our end markets and higher precious metal prices. We are delivering our efficiency programme, tightly managing working capital and generating cash from our more established businesses which we are continuing to invest for growth, particularly in battery materials and hydrogen. In the year we made good strategic progress. We began entering into partnerships to advance the commercialisation of eLNO and secured new customer wins in Fuel Cells. Our investment in sustainable technologies builds on our existing expertise and will enable the transformations in transport, energy, decarbonisation of industry and a circular economy that the world needs to reach net zero – transformations that are at the heart of achieving our vision of a cleaner, healthier world for today and future generations.

It is in this context that we’ve launched our new sustainability goals which will result in Johnson Matthey being a net zero business by 2040. Our sustainability agenda relates not only to the way we run our own business, but underpins our strategic focus on the current and future technologies we sell to our customers.

As the world aims to build back greener as we come out of the pandemic, our technologies have never been more relevant. We are already seeing this in the continued recovery of our key end markets and our strong start to the current year. Whilst our markets may remain uncertain as the pandemic continues to affect parts of the world differently we nonetheless expect low to mid teens growth in underlying operating performance in the coming year, before the anticipated benefit of currently strong precious metal prices.

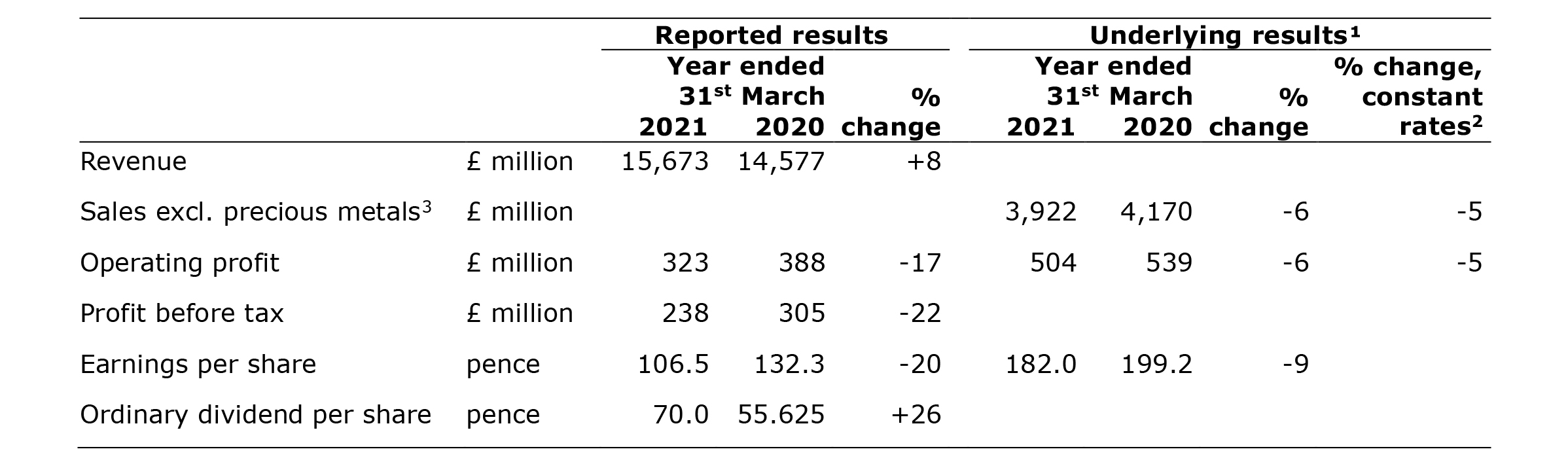

Reported results

- Reported revenue increased 8% driven by higher average precious metal prices

- Reported operating profit declined 17% largely driven by higher administrative expenses, and major impairment and restructuring charges

- Reported profit before tax declined 22% to £238 million as a result of lower reported operating profit which was impacted by higher administrative expenses and major impairment and restructuring charges

- Reported EPS declined 20% reflecting lower reported operating profit

- Cash inflow from operating activities increased by £171 million to £769 million driven by the strong management of working capital

Underlying performance¹

- Sales declined 5% (1H: -20% and 2H: +11% year-on-year) primarily driven by the impact of COVID-19 on our Clean Air sector although this business experienced a strong recovery through the second half

- Underlying operating profit declined 5%, due to higher administrative expenses and the impact of lower sales, which was moderated by higher platinum group metal (pgm) prices primarily in Efficient Natural Resources

- Underlying EPS declined 9% reflecting lower operating profit

- Free cash flow of £305 million was a strong improvement on the prior year, driven by the strong management of working capital across the group, and the reduction of backlogs despite the significant increase in pgm prices

- Balance sheet remains strong, with net debt of £775 million; net debt to EBITDA of 1.2 times

Impact of COVID-19

Throughout the COVID-19 pandemic, we have continued to balance the needs of all our stakeholders, with our priority being the health and safety of our people, customers, suppliers and the communities in which we operate. In the first half our sales declined materially, down 20%, as several of our end markets – particularly automotive – saw a significant decline as a result of the pandemic. The second half saw a strong recovery, with sales up 11% year on year, and activity across a number of our businesses is now back to pre-pandemic levels. As the world builds back greener following the pandemic, we are ideally positioned to help our customers with the complex challenges of addressing climate change through our suite of leading sustainable technologies.

Dividend

The board will propose a final ordinary dividend for the year of 50.0 pence at the Annual General Meeting on 29th July 2021. Together with the interim dividend of 20.0 pence per share, this gives a total ordinary dividend of 70.0 pence representing a 26% increase on the prior year. The board anticipates restoring future dividend payments to levels seen prior to the COVID-19 pandemic when circumstances permit. Subject to approval by shareholders, the final dividend will be paid on

3rd August 2021, with an ex-dividend date of 10th June 2021.

Societal Value Committee

The board has decided to create a Societal Value Committee to bring focus and oversight to our sustainability strategy, goals and performance against targets, which includes our climate management and ESG activities. All directors will be members of the committee, which will be chaired by Jane Griffiths, a Non-Executive Director.

Outlook for the year ending 31st March 2022

The current year has started well with a continuation of the strength seen in the second half of 2020/21. However, end market demand remains uncertain and subject to COVID-19 developments around the world, with the potential for supply chain disruption for some of our automotive customers.

In 2021/22, assuming our end markets remain robust, we expect low to mid teens growth in underlying operating performance at constant precious metal prices4 and constant currency. This largely reflects strength in Clean Air with improving auto production volumes, tightening legislation in Asia and higher order intakes within heavy duty diesel in the US. In addition, we expect an improved performance from Catalyst Technologies and continued progress in Health. We expect to see benefits from our efficiency initiatives across the group, although these will be partly offset by investing for growth in new technology areas such as battery materials and hydrogen.

At current foreign exchange rates, translational foreign exchange movements for the year ending 31st March 2022 are expected to adversely impact underlying operating profit by c.£25 million.

If precious metal prices remain at their current high level for the whole of the year (especially for rhodium and palladium), we would expect a further net benefit of up to £120 million5. Continued strong metal prices may also result in higher working capital therefore impacting free cash flow in the short term.

We continue to invest into strategic growth projects and capital expenditure is expected to be up to £600 million for the year. This reflects increased investment as planned into battery materials, which is on track and in line with previous expectations, investment in our pgm refineries to increase the resilience and capacity of these assets and investment in our hydrogen activities.

Enquiries

Investor relations

Martin Dunwoodie, Director of Investor Relations 020 7269 8241

Louise Curran, Senior Investor Relations Manager 020 7269 8235

Jane Crosby, Investor Relations Manager 020 7269 8242

Media

Sally Jones, Director of Corporate Relations 020 7269 8407

Simon Pilkington, Tulchan Communications 020 7353 4200

Notes:

1. Underlying is before profit or loss on disposal of businesses, gain or loss on significant legal proceedings together with associated legal costs, amortisation of acquired intangibles, major impairment and restructuring charges and, where relevant, related tax effects. For definitions and reconciliations of other non-GAAP measures, see pages 43 to 46.

2. Unless otherwise stated, sales and operating profit commentary refers to performance at constant rates. Growth at constant rates excludes the translation impact of foreign exchange movements, with 2019/20 results converted at 2020/21 average exchange rates. In 2020/21, the translation impact of exchange rates on group sales and underlying operating profit was negative c.£50 million and c.£6 million respectively.

3. Revenue excluding sales of precious metals to customers and the precious metal content of products sold to customers.

4. Based on actual precious metal prices in 2020/21.

5. Based on current precious metal prices as at 25th May 2021.

eLNO is a trademark of Johnson Matthey Public Limited Company