Hydrogen’s starring role: realistic applications will take centre stage in the future

JM's Phil Ingram uncovers hydrogen's starring role as an alternative to electrification in the decarbonisation of heavy industry and transport.

09 October 2023

It’s not what you have, it’s what you do with it

The idea of hydrogen as the ‘fuel of the future’ isn’t new. The ‘fuel cell effect’, using hydrogen to generate electricity, was first demonstrated by William Grove in 1839. Since then, we’ve seen hydrogen trialled in various applications, with experts now thinking we are on the cusp of commercial scale up. So why is the hydrogen hype different this time around?

As The Economist recently reported: “Unlike 20 years ago, when the hype came from enthusiasm for cars fuelled by hydrogen, this time the focus is on emissions-intensive industries that are difficult to decarbonise by electrification alone”

According to the Hydrogen Council, of the 1,046 large-scale hydrogen projects announced globally as of May 2023, 553 target large-scale industrial use. These forward-thinking projects are expanding the hydrogen value chain and trialling hydrogen use in heavy industry – from steel production to long-haul transport.

Industrial evolution: real change comes from within

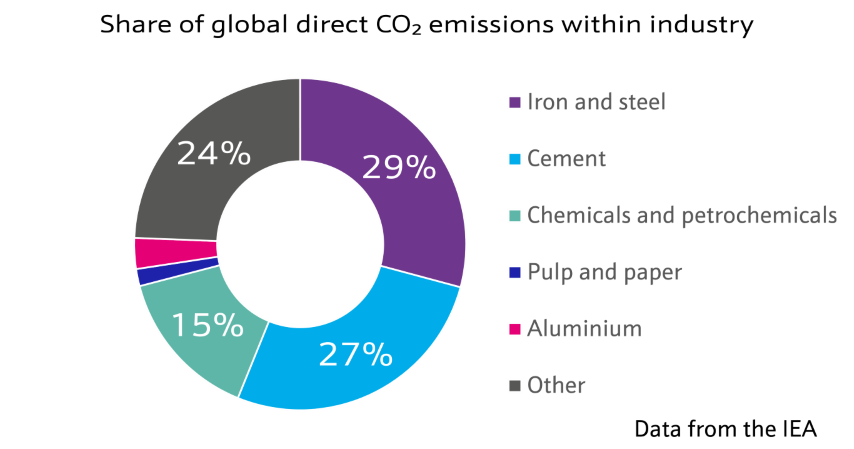

When we think about emissions-intensive industries, iron and steel, cement and chemicals top the list. In fact, according to the International Energy Association (IEA), production of these important materials was responsible for over 70% of industrial carbon dioxide (CO2) emissions in 2022 since they consume vast amounts of energy. However, by using hydrogen instead of burning fossil fuels to power the production plants, we can begin to decarbonise.

Interestingly, the industries themselves are driving this change. Equinor’s H2H Saltend project is applying Johnson Matthey’s LCHTM technology to produce hydrogen from natural gas with over a 95% carbon capture and storage (CCS) rate. This hydrogen will be used to reduce the emissions of the Saltend Chemical Parks by up to a third, as well as support the decarbonisation of the British Steel, one of the only two steel works in the UK.

Elsewhere in the UK, in two world-firsts, Unilever and Pilkington UK recently demonstrated the use of 100% hydrogen-firing for consumer goods production and flat glass production, respectively.

Fuel-feedstock duality

From fuels to pharmaceuticals to plastics, the chemicals on which the world relies are predominantly made of two elements: carbon and hydrogen. As the chemical industry pivots away from fossil feedstocks towards more sustainable carbon sources such as biomass, waste and captured CO2, non-fossil hydrogen feedstocks are also needed. Here electrolytic hydrogen, produced from water using renewable electricity, has a key role to play.

For example, in Spain, Repsol and Aramco will use Johnson Matthey’s pioneering FT CANSTM and HyCOgenTM technologies to transform renewable hydrogen and CO2 from the air into ultra-low emission fuels. In the deserted Magallanes region of Chile, the futuristic Haru Oni project is converting the same green feedstocks into sustainable methanol and gasoline. And by combining renewable hydrogen with nitrogen captured directly from the air, Siemens Energy recently demonstrated green ammonia production for sustainable fertilisers or sustainable shipping fuel.

Hydrogen: in for the long haul

While the hydrogen hype initially revolved around passenger cars, the automotive industry is increasingly recognising the critical role hydrogen fuel cell electric vehicles (FCEVs) will play in long-haul transport. In the heavy-duty sector, FCEVs offer longer range, faster refuelling and lower cost of ownership than battery electric vehicles.

FCEVs are still in the early stages of adoption. According to the IEA, there are currently over seventy thousand on the road globally, with buses and trucks each constituting almost 10%. And China, historically a step ahead in the fuel cell space, is home to the large majority of these trucks and buses.

But the market for heavy-duty FCEVs is expected to continue to expand both in and outside of China. Driven by policies such as the global memorandum of understanding on zero-emission medium and heavy-duty vehicles signed by 16 countries, we’ve seen more investment announcements from big players (e.g. Hyzon, Toyota, Daimler and Hyundai).

Unlocking the enormous potential of hydrogen

To realise hydrogen’s true potential, governmental incentives and regulation, such as the recent US Inflation Reduction Act, are required to encourage further investment in technology and, critically, infrastructure development. While localised hydrogen production plants near end-use facilities will be available, most hydrogen will likely be produced where space and resources allow. So hydrogen transport will be critical. And for renewable hydrogen production especially, storage infrastructure will help cope with the intermittency of production vs demand.

In the meantime, it is easy to get distracted by debates over applications that are easily relatable to consumers, like hydrogen-fuelled boilers for home heating or fuel cell cars. Hydrogen will undoubtedly be used to great effect in these markets, however its starring role in the net zero story is as an alternative to direct electrification in the decarbonisation of heavy industry and transport.

Read more