The PGMs: a circularity success story

30 January 2025

Platinum group metals (PGMs) – essential to products driving the energy transition and many other key technologies – are among the most highly recycled materials in the world, with recycling rates in some applications exceeding 95%. The story behind this success is not well known but deserves attention.

As the world’s largest refiner of secondary (recycled) PGMs2, a central player in global PGM supply chains and trade, and a leading provider of PGM market intelligence, Johnson Matthey has unparalleled insight into how PGM circularity works in practice. Here, we offer our insight to policymakers and others working to create a circular economy in all metals and materials crucial to our sustainable future.

The critical importance of PGMs – today and into the future

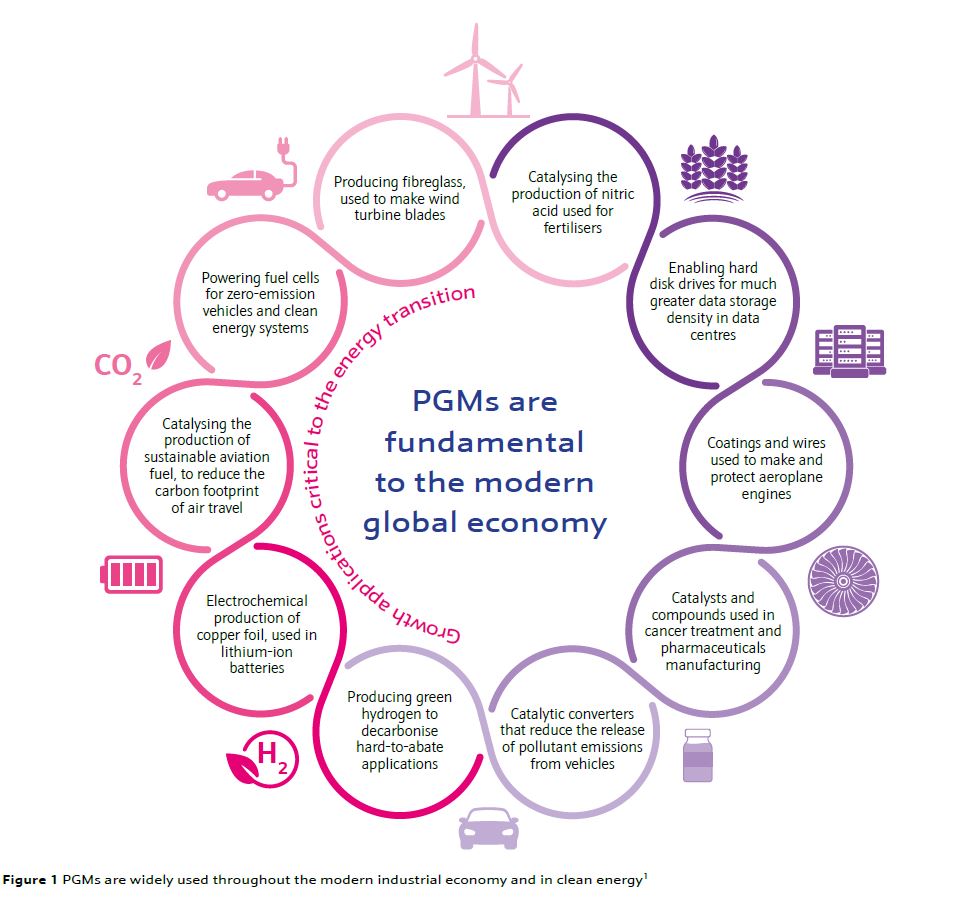

The automotive and industrial use of PGMs – a group of metals, consisting of platinum, palladium, rhodium, ruthenium, iridium3 – has grown dramatically over the past 50 years. The extensive use of these metals often goes unnoticed, with many unaware that PGMs are integral to countless technologies and processes that power modern life – and which drive the energy transition. Such applications include:

Reducing pollution from fossil fuel use

PGM catalysts are used to produce high-octane gasoline, helping to eliminate the use of leaded fuel and make vehicles more fuel-efficient. They are also fundamental to catalytic converters that remove the vast majority of pollutants like carbon monoxide and nitrogen oxides from vehicle exhaust before it is emitted.

Enabling modern healthcare

PGMs are used in biomedical devices such as cardiac catheters and pacemakers, in mammography to scan for breast cancer, in core anti-cancer treatments, and to make many pharmaceuticals.

Underpinning the digital economy

PGMs are ubiquitous within modern electronic circuitry and are also needed to make certain electronic components, such as the frequency filters used in mobile phones. PGMs enable cloud data storage, as data centres rely on hard disks and PGMs are needed for data storage within hard disks.

Making aviation viable

Jet engines used in today’s large aircraft operate at high temperatures. They could not work without PGMs providing thermal protection to key components. PGM catalysts are also used to produce advanced sustainable aviation fuels that will reduce fossil fuel carbon emissions in the future.

Powering the hydrogen economy

Among other hydrogen-related applications, PGM catalysts sit at the heart of proton-exchange membrane (PEM) technology, used in both fuel cell vehicles and in electrolysers that produce hydrogen by splitting water.

Unlocking clean energy

As well as their key roles in sustainable aviation fuels and clean hydrogen, PGM-protected equipment is necessary to make the fibreglass for wind turbine blades, and the copper foil that goes into lithium-ion batteries in electric vehicles.

Recycling underpins PGM use

Meeting the rising demand for PGMs would not have been possible without circularity. Almost 60% of PGM used on new products every year is now recycled metal, from both the open and closed loops.

The high level of circularity in PGMs is driven by their financial and industrial value. PGMs can be recycled many times and remain in use indefinitely, because recycling does not change the physical properties or how the PGM can be used.

The open loop and the closed loop

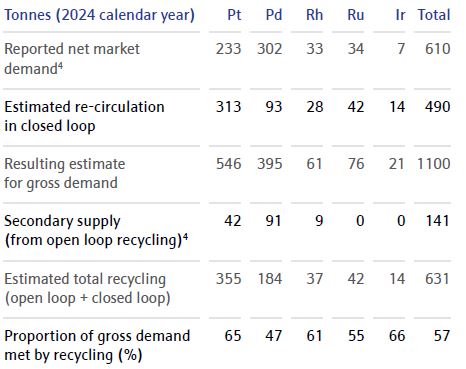

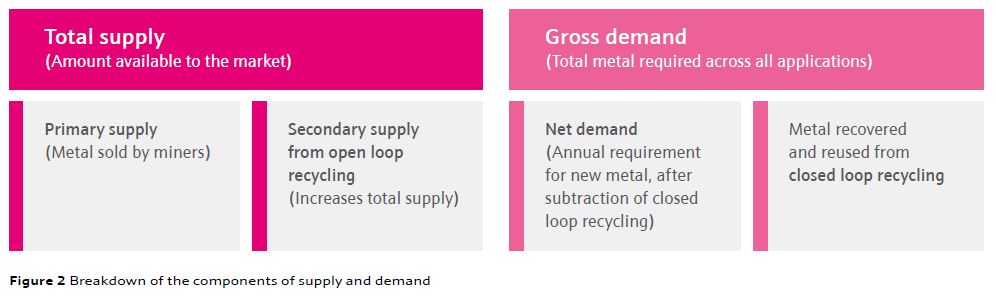

For the first time we reveal the full scale of PGM recycling by publishing an estimate of the size of the closed loop. Open loop recycling of PGM returns metal to the market and is a well-quantified figure. This is because it contributes significantly to market supply, emphasising how incorrect it is to only consider primary metal from mines as ‘supply’.

Closed loop recycling remains more enigmatic to the wider world because ownership of the metal is retained by the original purchaser and reused within the same application. Unlike open loop recycling, the closed loop is not reported and is often overlooked. But the closed loop is far from minor:

it is in fact several times larger than the open loop.

Table 1 Contribution of recycling to gross consumption of PGMs. Note: Preliminary figures for 2024 calendar year. Market demand excludes investment. Closed loop figures are approximate

NB: Percentage is not an end-of-life recycling rate since it is being compared to current demand, not to original metal input, and only recycling undertaken within this annual period has been considered.

Circularity boosts the sustainability of PGM use

The success of PGMs show that, even as consumption grows, a focus on circularity can ensure that ‘urban mines’ become a reality in serving the needs of the industrial economy.

The true scale of PGM recycling also underscores that circularity is not merely secondary to mining, but an equally important consideration in securing metal availability. This is particularly true as we look ahead to the growing need for industrial metals through the energy transition, which cannot be sustainably met through mining alone.

And recycling has importance beyond securing availability: the carbon intensity of recycled PGM is about 97% lower than that of newly mined metal today.

Key recommendations for policymakers

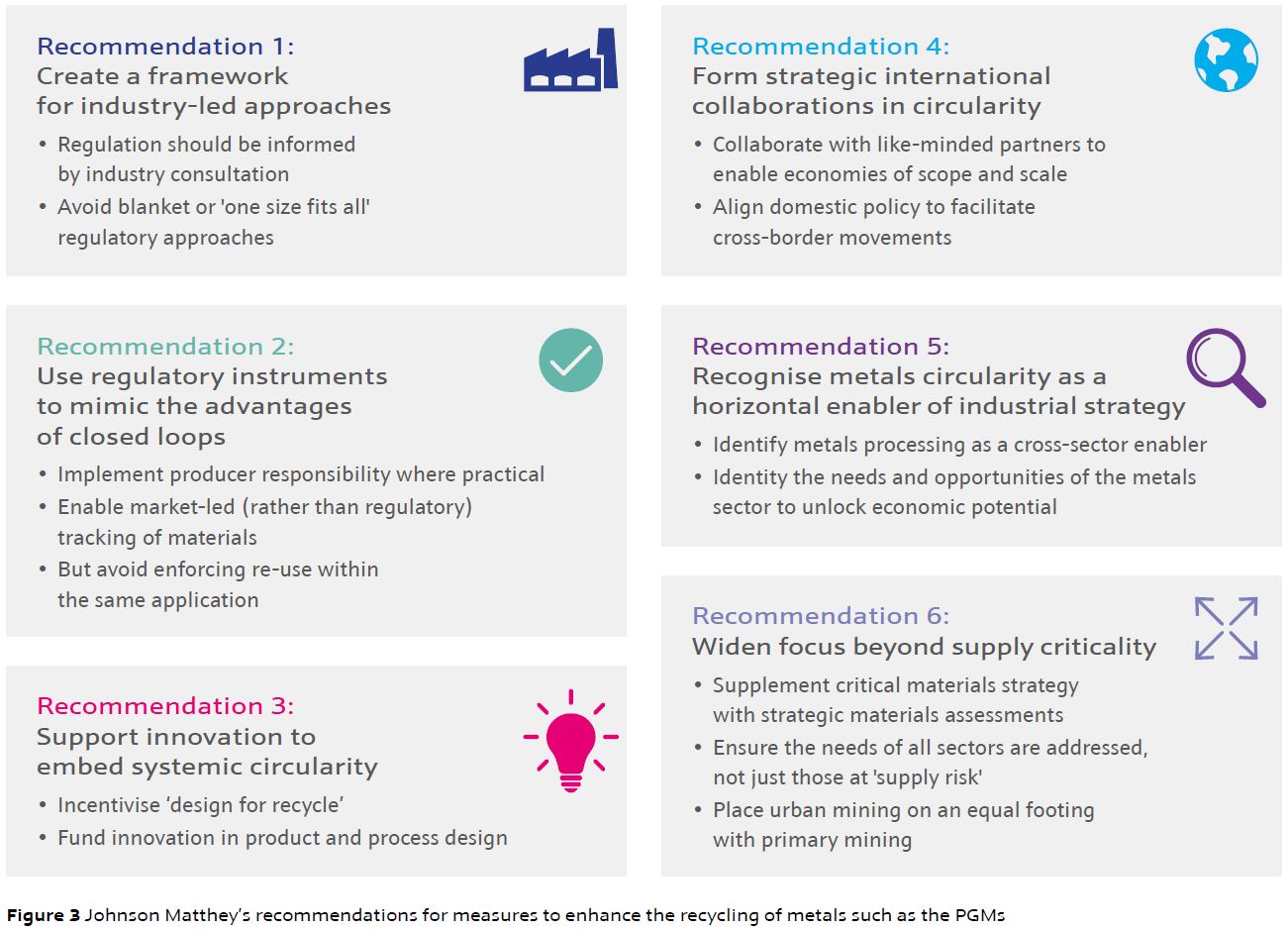

Achieving success in circularity is at least as complex and challenging as it is in mining, and regulatory approaches require careful consideration to avoid unintended consequences. PGM circularity is based on a market-driven, global ecosystem that took decades to evolve to its present form. Regulation must build on, and not hamper, that maturity. Our recommendations to policymakers are summarised below (Figure 3) and discussed in more detail in our white paper.

For other critical raw materials, there are learnings to be taken from the success of PGM circularity, but the best regulatory measures are informed by industrial experience. We urge regulators to create a framework for industry-led approaches.

For example, using regulatory measures such as producer responsibility can mimic the benefits of closed loops for enhancing recycling rates, because the original purchaser of the metal has an interest in recovering and reusing it from end- of-life material. The PGM industry drives sustainability through routine recycling and so regulations such as the EU taxonomy should include all of this within the legislative description of

its recycling activity, not just recycling of ‘hazardous waste’.

Furthermore, policymakers can help to unlock innovation and embed ‘design for recycle’ in products and their supporting supply chains right from the start. This is likely to reduce future recycling costs and will support the emergence of effective end-of-life collection networks through market forces.

But for circularity to become embedded in the economy it must be cost-effective, so recycling operations must have access to sufficient volumes of relatively consistent material. We urge policymakers to form strategic international collaborations towards this end. Indeed, for PGM circularity to continue as the success it is, global cooperation on the free movement of PGM-containing material across borders is needed.

Further, metals circularity should be recognised as a horizontal enabler of industrial strategies. PGMs support clean energy, digital technologies, defence and aerospace, and many life science technologies, with associated metal processing and recycling happening in common facilities. Yet the PGM industry generally sees a lack of supportive policy to capitalise on these opportunities. This must change.

Building on the above, forward-looking reviews to identify metals of strategic economic importance are needed, and a widening of focus beyond mined supply criticality. PGMs have shown that it is possible to move away from heavy reliance on extraction towards urban mining – but the ‘urban miners’ who make that happen need appropriate support.

1Johnson Matthey (2024) | Platinum group metals: The unsung heroes of our modern world

2By volume

3Osmium is a PGM, but is not included when we reference these metals as its applications are very niche

4Johnson Matthey (2023) | Johnson Matthey offers 100% recycled platinum group metal (PGM) content

Full whitepaper: