Harmonising hydrogen: the need for global alignment in low carbon hydrogen regulation

To enable the hydrogen economy to grow at pace and facilitate trade, Andy Walker, JM's Technical Market Insights Director, calls for global alignment in low carbon hydrogen standards.

23 November 2023

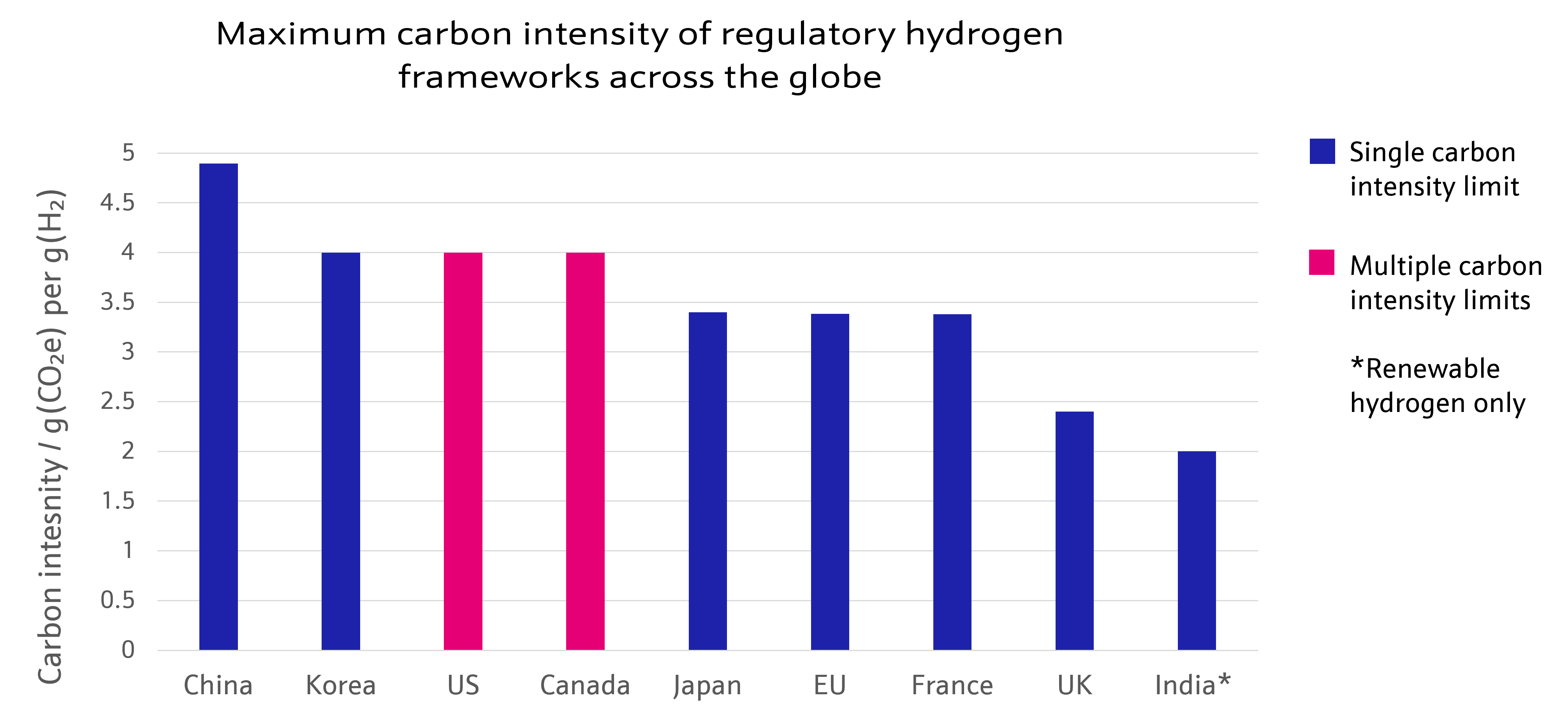

Hydrogen has a key role in enabling the decarbonisation of hard to abate sectors in the net zero transition. That’s why governments are driving and managing hydrogen investment by putting in place their own hydrogen standards. These standards dictate which projects are truly ‘low carbon’ and should therefore receive government support.

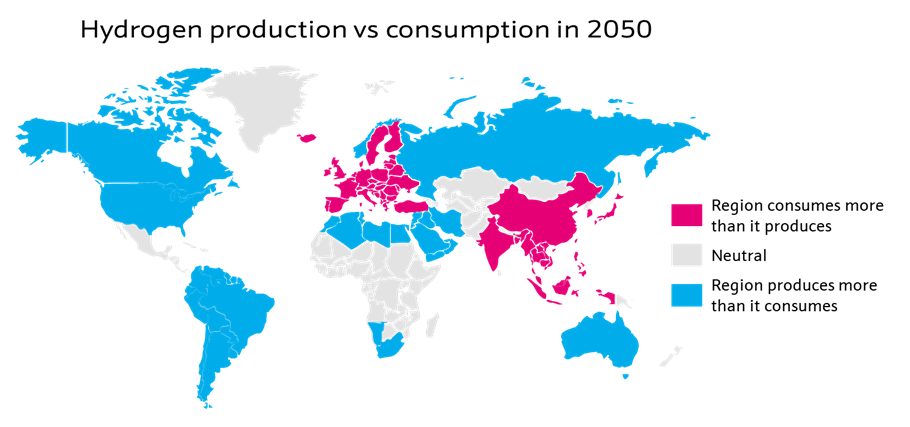

To build a global hydrogen economy, which can effectively facilitate local and international hydrogen trade, these standards must be globally aligned.

Source: International Energy Agency Global Hydrogen Review 2023

The importance of feedstock flexibility

Only the Green Hydrogen Standard for India specifies that hydrogen production must be from renewable feedstocks and powered using renewable electricity (renewable hydrogen).

While renewable hydrogen will play a crucial role, complementary low carbon hydrogen production routes are needed to grow the hydrogen market and meet demand. This is especially important for high demand regions such as Europe.

The UK was one of the first countries to publish a hydrogen standard with clear methodology in the spring of 2022. The UK Low Carbon Hydrogen Standard is independent of feedstock but with the lowest carbon intensity limit of similar regulatory standards under development. Under this leading standard, both renewable hydrogen projects and those producing hydrogen from natural gas with carbon capture (CCS-enabled hydrogen) are eligible for support. For example, bp’s HyGreen Teesside and H2Teesside projects.

In Germany, import of CCS-enabled hydrogen is included in its National Hydrogen Strategy in the short- to medium-term until sufficient hydrogen produced from renewables is available. And as a result German utility company, RWE, has already agreed a partnership with Equinor to build a pipeline to import CCS-enabled hydrogen from Norway.

Source: reproduced from Hydrogen Council Global Hydrogen Flows

Hydrogen regulation driving investment

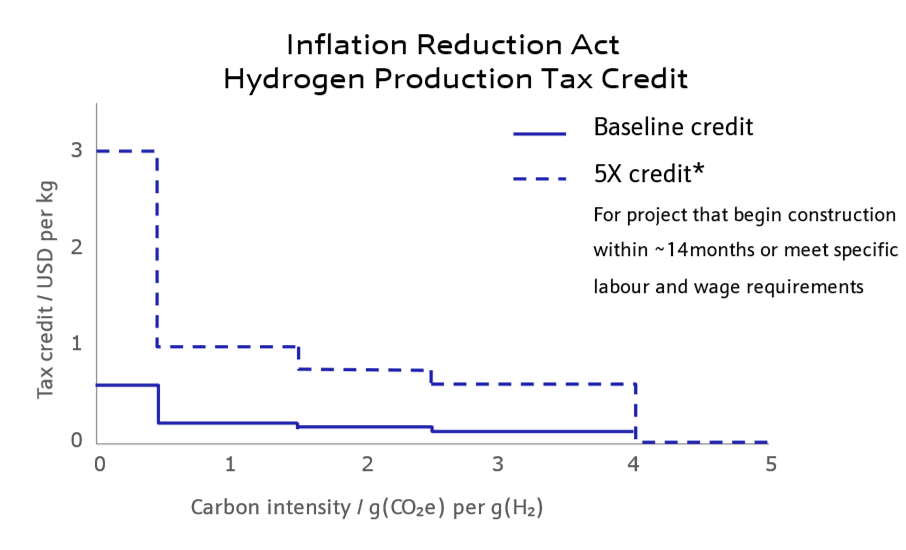

The US Clean Hydrogen Production Tax Credit (part of the Inflation Reduction Act) is also feedstock-independent. It offers additional flexibility by specifying multiple levels of tax credit for different carbon intensity ranges.

The Inflation Reduction Act is driving hydrogen investment. In fact, four of the US’s seven hydrogen hubs plan to produce both renewable and CCS-enabled hydrogen, including the HyVelocity Hub and the Appalachian Regional Clean Energy Hub.

Did you know?

Johnson Matthey (JM) develops and manufactures catalyst coated membranes (CCMs) – the performance-defining components at the heart of renewable hydrogen electrolysers. As the only commercial scale CCM supplier with in-house catalyst and membrane technologies, we can leverage both layers, optimising our components to meet customers targets on performance, durability and cost.

Learn more

The need for well-defined emissions calculations

Some specifics of the Inflation Reduction Act are still under development and project developers will need these clarified to decide which credits to apply for. One area requiring clarification is the calculation of the carbon intensity of the hydrogen, and whether emissions upstream and downstream in the hydrogen value chain will be included.

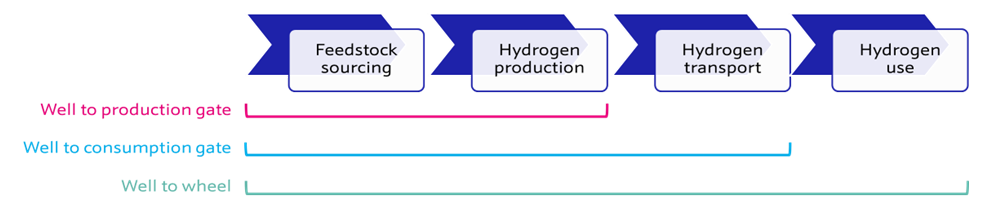

Most hydrogen standards, such as the UK, Japanese and Korean legislation, cover “well to production gate emissions”, from extraction of feedstock to the production of hydrogen. For renewable hydrogen, this includes the carbon emissions associated with upstream electricity generation.

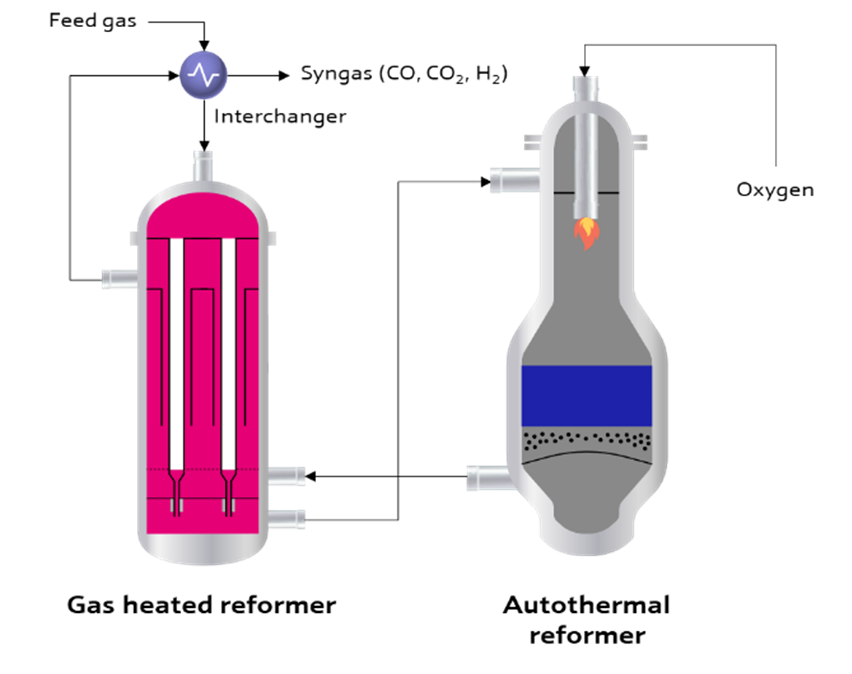

For CCS-enabled hydrogen, this includes any methane emissions in upstream natural gas procurement, as well as carbon dioxide emissions produced in the hydrogen production process that are not captured. As a result, hydrogen standards are helping to drive world-class technology development in both these fields and demonstrate that CCS-enabled hydrogen production still meets stringent standards for carbon intensity.

Did you know?

JM’s LCH™ technology for CCS-enabled hydrogen and ammonia offers autothermal reforming (ATR) and ATR coupled with gas-heated reforming (GHR-ATR). These flowsheets enable carbon capture rates of up to 99%. Our GHR-ATR flowsheet offers the highest process efficiency commercially available today, minimising natural gas use. Together these benefits result in a low carbon intensity that meets even the UK’s stringent low carbon hydrogen standard.

Learn more

Other hydrogen standards, like the EU’s Renewable Energy Directive II, go a step further to include emissions associated with hydrogen’s transport and use. This adds complexity as many commercial scale hydrogen projects, supply to a wide variety of end-uses using different transport mechanisms. For example hydrogen produced in Equinor’s H2H Saltend project will be used to decarbonise steel production and replace natural gas in powering chemicals production.

This inconsistency presents an obstacle for developers trying to build a global hydrogen network, whose projects are eligible for support in some regions but not others.

The drive for international consistency

It’s clear that we need to work across borders to develop a consistent hydrogen standard based on the best available technology to better facilitate interoperability. This is becoming increasingly important as new hydrogen strategies and regulations continue to be developed and implemented globally, and we begin to understand the picture of future hydrogen trade.

The International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) recently finalised its "well to consumption gate" methodology for determining the greenhouse gas emissions associated with the production, conversion and transport of hydrogen. The good news is that work has already started on codifying this as an ISO standard. The technical specification is expected to be published by the end of 2023, with the first draft anticipated by the end of 2024.

The objective is to enable the hydrogen economy to grow at pace and facilitate global hydrogen trade. As such, this ISO standard should be feedstock and technology neutral, centre around carbon intensity limits and follow the consistent emissions accounting methodology proposed by the IPHE.

Read more