Resilient performance in the first half

Underlying performance¹,²

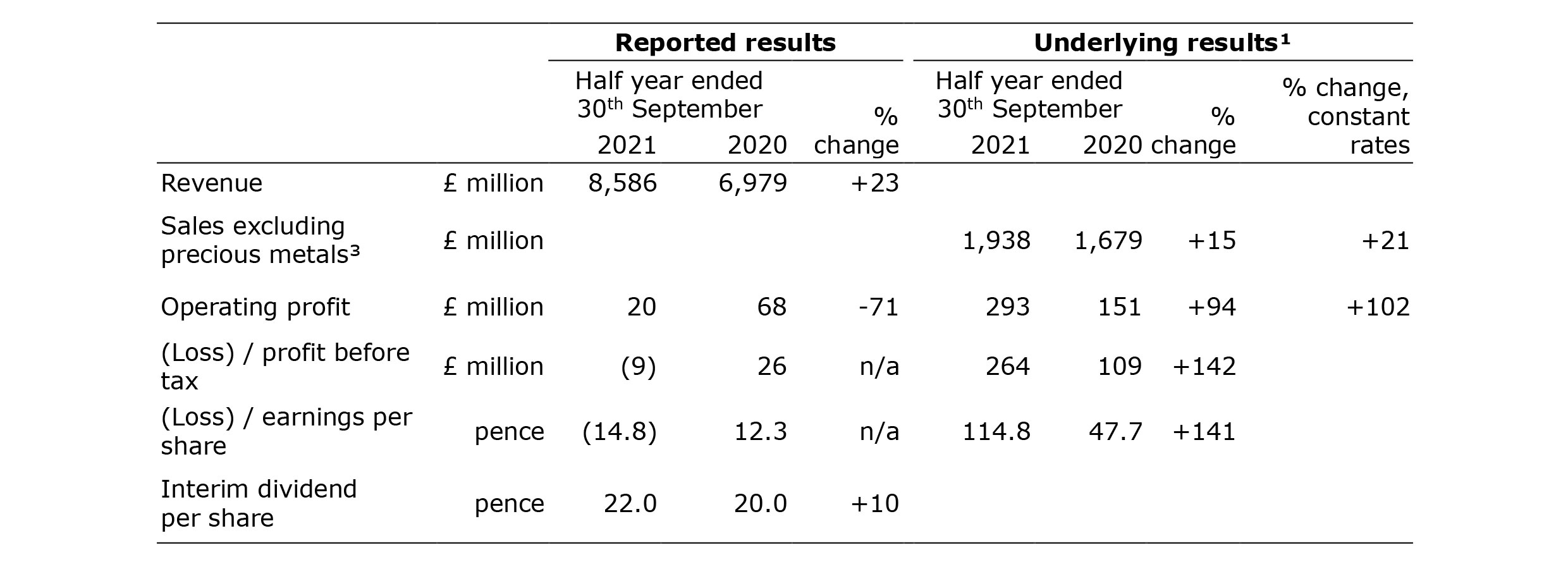

- Sales of £1.9 billion, up 21%, driven by a strong recovery in Clean Air and Efficient Natural Resources

- Underlying operating profit of £293 million, up 102% and ahead of pre-pandemic levels, driven by strong sales growth and higher average precious metal prices

- Underlying EPS of 114.8 pence, up materially reflecting higher underlying operating profit and lower net finance costs

- Free cash flow of £189 million, benefiting from continued strong management of working capital (1H 2020/21: £256 million)

- Strong balance sheet with net debt of c.£700 million as lower auto demand benefited working capital; net debt to EBITDA of 0.9 times

- Return on invested capital (ROIC) of 17.7%, up from 10.4% in the prior year driven by higher underlying operating profit

Reported results

- Revenue increased 23% primarily driven by higher average precious metal prices

- Following the announcement of our intention to exit Battery Materials, the assets have been impaired by £314 million

- Operating profit of £20 million, reflecting the one-off impairment in Battery Materials

- Loss before tax of £9 million, driven by lower operating profit

- Reported loss per share of 14.8 pence

- Cash inflow from operating activities of £412 million (1H 2020/21: £482 million)

- Interim dividend of 22.0 pence per share, up 10%

- Share buyback of £200 million, beginning in the New Year

Key developments

- A resilient trading performance, with strong sales growth driven by a recovery in Clean Air and Efficient Natural Resources

- Portfolio changes – agreed the sale of Advanced Glass Technologies for £178 million, and in discussions about a potential sale of Health

- Announced intention to exit Battery Materials

- Good momentum across our hydrogen businesses of Fuel Cells and Green Hydrogen

- New five-year framework contract with EKPO (ElringKlinger Plastic Omnium JV) to supply fuel cell components into commercial vehicle applications

- Following the completion of our hydrogen technologies capacity expansion in the UK and China, planning further expansion across these regions

- Increasing pipeline of opportunities in blue hydrogen – now over 20 projects – including HyNet which continues to move towards commercialisation in 2025

- In Clean Air, on track for strong cash generation in 2021/22

- Delivered £42 million of cost savings, from our total programme of £110 million per annum by 2023/24

Robert MacLeod, Chief Executive, commented:

We delivered a resilient trading performance in what has been a challenging environment, given the supply chain volatility which has affected a number of our end markets.

Looking forward, the changing world around us means that Johnson Matthey has never been more relevant. Our metal expertise and process technologies are critical to many new markets focused on climate change solutions and give us a strong competitive advantage. We have strong foundations in Clean Air and in Efficient Natural Resources and exciting opportunities to drive our future growth in circularity, hydrogen and decarbonisation.

To ensure we are focusing our resources on these core growth opportunities we have taken some strategic decisions around our portfolio. In particular, we announced our intention to exit Battery Materials as we concluded that this business would not generate adequate returns for us. In addition, today we are announcing that we have agreed the sale of Advanced Glass Technologies and are in discussions about the potential sale of our Health business.

After eight years in the role, I will be stepping down as Chief Executive, with Liam Condon joining as my successor from 1st March 2022 and I wish him well in leading Johnson Matthey through the next stage of its evolution.

Outlook for the year ending 31st March 2022

Our expectations on guidance for the year ending 31st March 2022 are unchanged from our trading update on 11th November.

Demand remains strong in many of our end markets. However, supply chain volatility especially the shortage of semi-conductors is affecting production for a number of our auto and truck customers. Global auto production is now forecast to decline 5% for our fiscal year which is a 14% reduction since our trading update in July⁴. Consequently, precious metal prices have also declined, largely because of the lower demand from the automotive industry. We are also experiencing acute temporary labour shortages in the US that are adversely impacting our Health business.

For 2021/22 we expect growth in underlying operating performance to be low single digit at constant precious metals prices⁵ and constant currency.

If precious metals prices remain at their current level⁶ for the rest of this year, we would expect a full year net benefit of c.£45 million.

At current foreign exchange rates⁷, translational foreign exchange movements for the year ending 31st March 2022 are expected to adversely impact underlying operating profit by c.£15 million.

Our capital expenditure is now expected to be c.£450 million for the year⁸ given our intended exit from Battery Materials.

Dividend and share buyback

The board approved an interim dividend of 22.0 pence per share, an increase of 10% against the prior year (1H 2020/21: 20.0 pence per share). The interim dividend will be paid on 1st February 2022 to shareholders on the register at 3rd December 2021.

The board has also approved a share buyback of £200 million that will commence in the New Year.

Chief Executive Announcement

As previously announced, Robert MacLeod will step down as Chief Executive and from the board on 28th February 2022. Robert will stay on to support the transition process until the Company’s Annual General Meeting on 21st July 2022, when he will then retire from JM. Liam Condon will succeed Robert MacLeod, joining as Chief Executive on 1st March 2022.

Group Management Committee Change

Joan Braca, Chief Executive Clean Air, has decided to leave Johnson Matthey. Joan’s last day will be on 31st December 2021.

Enquiries

Investor Relations

Martin Dunwoodie, Director of Investor Relations, 020 7269 8241

Louise Curran, Senior Investor Relations Manager, 020 7269 8235

Jane Crosby, Investor Relations Manager, 020 7269 8242

Media

Barney Wyld, Group Corporate Affairs Director, 020 7269 8001

Harry Cameron, Tulchan Communications, 07799 152 148

Notes:

1. Underlying is before profit or loss on disposal of businesses, gain or loss on significant legal proceedings together with associated legal costs, amortisation of acquired intangibles, major impairment and restructuring charges and, where relevant, related tax effects. For definitions and reconciliations of other non-GAAP measures, see pages 46 to 50.

2. Unless otherwise stated, sales and operating profit commentary refers to performance at constant exchange rates. Growth at constant rates excludes the translation impact of foreign exchange movements, with 2020/21 results converted at 2021/22 average rates. In 1H 2021/22, the translational impact of exchange rates on group sales and underlying operating profit was negative c.£71 million and c.£6 million respectively.

3. Revenue excluding sales of precious metals to customers and the precious metal content of products sold to customers.

4. As forecast by external consultants – IHS (October 2021).

5. Based on actual precious metal prices in 2020/21.

6. Based on current precious metal prices as at 22nd November 2021.

7. Based on foreign exchange rates as at 22nd November 2021.

8. Our previous guidance was for capital expenditure of up to £600 million for the year, which included our investment in Battery Materials.