PGMs are constantly moving worldwide in different forms, in a truly global market. Metal initially sold in one region may not be used, recovered, processed, or resold in that region.

PGMs are only mined or recycled in a few locations in the world, but PGM containing products that are manufactured and fabricated by specialist companies are sold in a multitude of global markets. When PGM-containing products reach their end of life, this worldwide source of material needs to be sent to specialist refiners for effective recovery and recycling. PGMs are valuable and so buying, selling and shipping these metals is complex. They require proper security, financing, liquidity, quality verification, handling and storage arrangements.

Movement in PGM supply

Primary PGM supplies from South America, Russia and North America move via air transport to refineries or customer accounts globally (although current restrictions on Russian entities such as sanctions and import penalties limit exports). In most cases it is delivered to refiners and fabricators that process metal, which is then used to make final products elsewhere. They do this on behalf of their customers, but do not usually own the metal themselves. So the physical location of metal is often different to the owner location, which can be exchanged in a seamless electronic process.

Johnson Matthey and other companies handling relatively large PGM quantities through worldwide refineries and liquidity hubs can facilitate metal movement between regions. Metal can be moved as ‘good delivery’ sponge between refiner and fabricator accounts, or virtually using electronic processes.

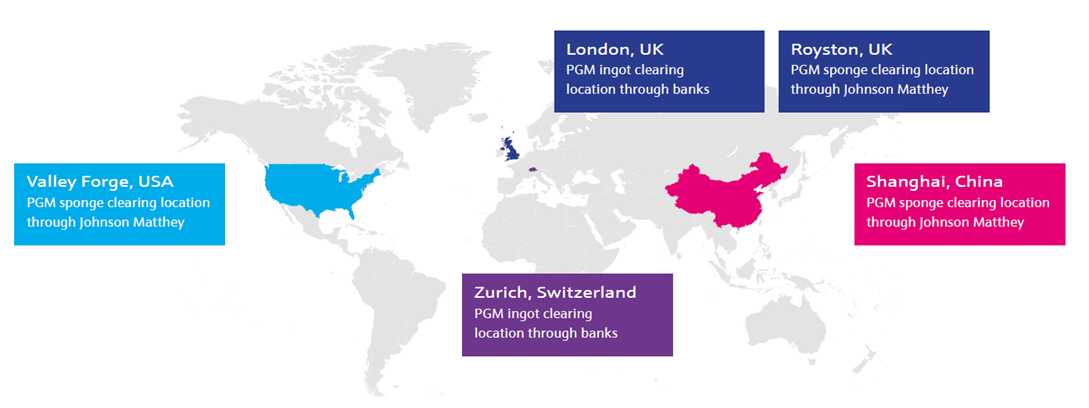

Ingots that have been certified to meet LPPM ‘good delivery’ standards may be delivered into bank depositories in London or Zurich for trading. Good delivery metal held in Western vaults is interchangeable and can move between locations to satisfy contractual obligations without ever being used for manufactured products.

These liquidity hubs, or ‘clearing locations’ expedite trade between regions, allowing user to buy and sell metal with confidence.

Movement in PGM demand

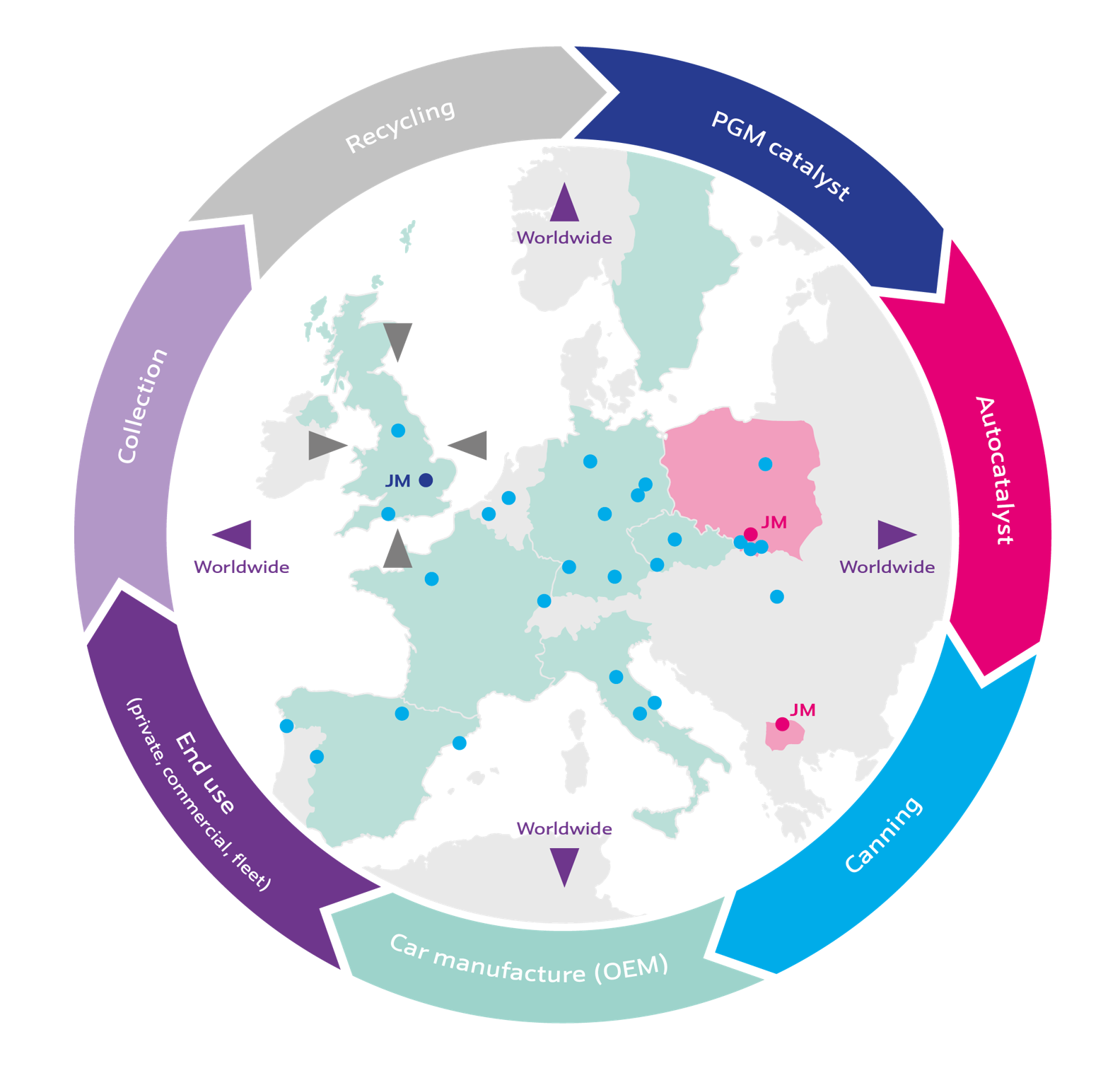

PGMs may cross borders in a range of parts or products and not appear in trade data, where is it not an obvious PGM movement. For example, automotive emissions control catalysts containing PGM may be produced in one region, shipped to another region for canning, then to another for fitment onto new vehicles, and then these vehicles can be exported to yet another region for sale. None of this will be captured as an obvious PGM movement in trade data.

Johnson Matthey and other recycling companies handle a wide variety of often hazardous and challenging spent material forms. So they have optimised their processes, while maximising efficiencies and economies of scale for the metal recycling process. This centralised approach, avoiding multiple small domestic recyclers, has resulted in a more optimised and cost-effective global recycling solution.

Once PGMs have been recycled, the secondary refiner (recycler) will often not buy or use the recovered metal, so it needs to be shipped again to settle contracts – facilitated by the hubs.

Trade and export barriers that restrict metal movement are important to consider, for example in China and India. For the rest of the world, cross-border movement of PGM ingot, sponge, product and end-of life material are a normal and vital part of the PGM supply chain.